Home > Money > News > Santander winning current account switching war

Santander winning current account switching war

SANTANDER have been the biggest winners so far in the UK's fight to boost current account switching, figures released last week by TNS have revealed.

Santander gained 21% of UK account switchers during November, TNS said, but the bank lost 9%.

Other switching winners' net gains were similarly modest: Nationwide increased their accounts by 6% and Halifax by 4%.

The results seem to show that the banks' new seven day switching service launched in September hasn't had the dramatic effect on the current account market that some hoped for: one Uswitch poll found that 40% of respondents wanted to switch after the seven day service came in.

Disappointingly, too, it doesn't look as though the effect is just a slow burn.

Sticky market stays sticky

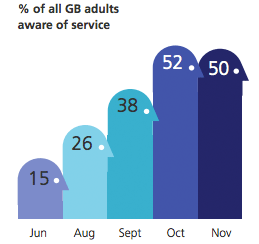

TNS found that awareness of the seven day switching service levelled off in November at about 50% and noted that, in their previous study on the subject, only about half of respondents to their research were interested in switching accounts.

Research conducted for the John Gilbert Financial Research (JGFR) also recently found that about 50% of UK adults are totally happy with their bank and have no plans to switch.

Source: TNS November 2013

48% are less than happy but don't plan on moving and just 2% intend to switch current accounts.

Overall, these studies suggest that most people that are interested in switching have heard about the new seven day service but it hasn't persuaded them to actually move.

In October, Payments Council figures show, the number of people moving accounts increased by 12,980 compared to the same month in 2012. Just over 115,000 people switched that month overall.

It was a slightly larger increase than September, when just 9,000 more people switched current accounts than in September 2012 (89,000 switchers overall).

Rise in 'sort of' switchers

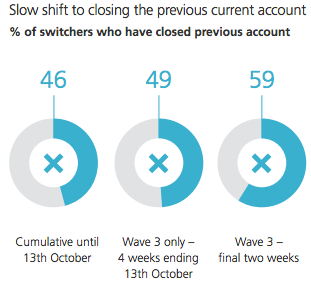

An interesting aspect of the TNS report was the attention that it paid to whether recent switchers had closed down their previous bank account.

Source: TNS November 2013

As you can see above, after three weeks, 41% of switchers still hadn't closed their 'old' account.

We can see from the attention that premium current accounts and bank special offers give to using the account switching service - i.e. moving direct debits and standing orders to the new bank - and to minimum monthly deposits that banks fear consumers will open a new account but never truly move from their old bank, particularly if they have other products there.

From a consumer point of view that fear seems well founded, why go to the trouble to shut down an account you might need in the future?

Last year's EY Global Consumer Banking Survey, found that UK consumers are increasingly likely to bank in multiple places.

44% of UK respondents to their survey banked in one place, down 6% from 2011.

In 2011, the survey found, 16% of consumers banked with three or more institutions; in 2012, that had risen to 19%.

Biggest switching losers

More mobile consumers are far from a win-win for banks, however.

The TNS study shows that some of biggest banks, in particular, are losing more customers than they gain.

Biggest losers

- Lloyds: down 6%

- Barclays: down 4%

- Natwest: down 3%

- RBS: down 3%

The latest figures don't take into account the newest problems at the floundering Co-op bank, which grew its customer base by 1% in this period.

But, in a report to stakeholders, the bank noted that it had actually seen a "material reduction" in the number of people switching their accounts after the seven day switching service was launched and suggested that rivals were tempting potential switchers away with hefty advertising campaigns.

Given the recent revelations about the bank, it seems unlikely that their performance will pick up from that low point.

Among current switchers, a good reputation seems to be key for consumers to actually move banks.

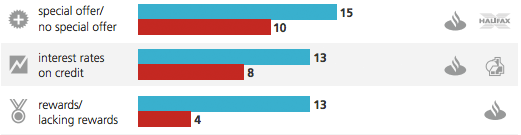

"We have consistently found that reputation is driven by great service and, while customers want best value and increasingly expect to be rewarded, these are weaker drivers of loyalty and satisfaction," Maureen Duffy, CEO of TNS UK said.

Source: TNS, November 2013. Blue shows main reason for switching to the new bank, red the main reason for switching away.

She added that Nationwide seem to be getting the balance between service and value right.

However, Santander's dominance among current account switchers, see above, would seem to suggest that many consumers are choosing to move for special offers for moving and ongoing deals: Santander have the UK's leading cash back current account.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties