Home > Money > News > Where you live won't protect you from ID theft

Where you live won't protect you from ID theft

THINK living in a detached house in the country keeps you safe from identity fraud? Think again, a CIFAS report out this week says.

The UK Fraud Prevention Service's latest identity crime briefing reveals that, contrary to popular belief, those living in blocks of flats or shared houses aren't more vulnerable to identity theft.

Increased access to personal data, online and through database theft, means criminals are relying less on housing type and geography to profile their victims, researchers suggested.

"The findings of this report confirm that everyone is vulnerable to fraud and that anybody can fall victim," Richard Hurley, CIFAS Communications Manager, noted.

Despite increased awareness of identity theft, however, most people still believe that they're unlikely to become victims.

Just 36% of respondents to an Equifax poll released earlier this month said they considered themselves at risk of ID fraud.

What does your house say about you?

Previous CIFAS reports have suggested that living in a flat or house of multiple occupancy (with flatmates, as opposed to a family home) increases the risk of fraud since criminals can more easily steal important post that they can then use to commit a crime.

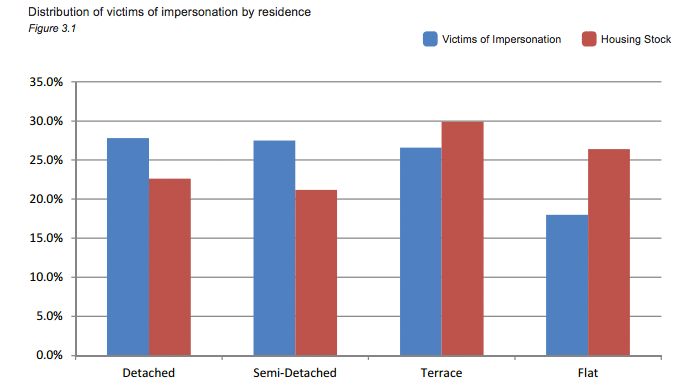

However, by combining fraud figures with Ordnance Survey information on housing stock researchers found that detached and semi-detached houses were actually more likely to be hit.

The type of house you live in says something to fraudsters, the researchers point out.

If the fraud involves taking a physical item, like a credit card, criminals may believe that those in detached properties have more money to take.

In other cases, flats are simply less convenient.

For example, there's a type of mail order fraud where the fraudster orders goods to a house and then collects them soon after, apologising that they were wrongly delivered.

It may be easier to get the homeowner to come to the door in a detached and semi-detached house.

Courier fraud, in which the criminal gets the victim to first give away their PIN number and then their card to a courier 'from the bank' (more information here), might concentrate on these types of homes for the same reason.

Fraud goes online

However, another explanation is simply that fraud is increasingly going online.

Phishing attacks and malware are replacing going through the bins or intercepting important mail.

The huge amounts of personal data now available through online criminal networks, plus far less obvious risks than physical theft, make this move a bit of a no brainer.

While knowledge of an area, including property type, still helps criminals to commit some types of fraud, in many cases the sheer amount of other information available about the victim renders it unnecessary.

Urban hotspots remain

As ever, CIFAS found that identity theft continues to be concentrated in urban areas, even when population is taken into account.

In and around London, Manchester, Birmingham and Wolverhampton, the number of fraud per thousand people is still much higher than elsewhere in the UK.

High population continues to offer a "cloak of anonymity" that allows modern fraudsters to carry out a very high volume of crimes, the researchers said.

Don't panic!

Fraud statistics from the last few years show that just three in every thousand people fall victim to fraud.

While this week's report casts new light on those most likely to be at risk, rates of many types of fraud have fallen in recent years.

However, complacency remains a key risk factor.

ID theft mis-selling scandals have shown that insurers have been willing to inflate the risk of fraud in order to sell policies.

Consumers may now be more suspicious about fraud warnings, even when the advice on offer is accurate and may protect them from fraud.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties