Home > Money > News > Will the Lloyds blackout make customers switch? Probably not

Will the Lloyds blackout make customers switch? Probably not

LAST weekend, Lloyds Banking Group customers across the UK were left confused and embarrassed when a technical glitch left them unable to pay at the till or take out cash.

The blackout was relatively minor - according to Lloyds, it affected customers making purchases between 3pm and 6pm on Sunday and about 3,500 Lloyds ATMs in the same period - and was dealt with competently.

The Lloyds brands - Lloyds, TSB, Halifax and Bank of Scotland - communicated well with customers affected at the time (if that sounds like a given, it isn't) and have been somewhat sympathetic since, though we haven't seen any definitive answers on compensation.

Nevertheless, many have speculated that angry customers will move their current accounts elsewhere.

The 2012 RBS/Natwest blackout

To think about just how unlikely that is we need to go back to June 2012, when RBS had a much worse IT blackout.

The RBS blackout lasted for five days for some customers from the 20th, which was a Wednesday, right through to the next Monday, the 25th.

RBS dealt with the problem fairly well and some customers got compensation as a result of the problems.

However, unlike the Lloyds glitch, which has been traced back to a HP server, the RBS issue was caused by old legacy IT systems, an issue so systemic that blackouts were almost certain to happen again.

The FCA is still investigating the crash.

Customers were angry with RBS and many predicted that they'd leave: a Guardian online poll found that 72% were furious enough to switch banks.

Now, though, we can look at the numbers and see that despite the huge inconvenience of the blackout and widespread agreement that IT problems were likely to recur, people didn't switch away from Natwest and RBS.

Staying put

Although challenger banks like Co-operative and comparison services claimed to experience increases in applications after the RBS crash, as we reported at the time, their optimistic figures didn't actually amount to many customers.

In a statement to investors in November 2012, the RBS group confirmed that they hadn't lost many customers over the preceding months.

"Customer deposits remained flat... with no significant outflows following the Group technology incident," the bank said.

Customers may have decided to stay as a result of the £175 million in all (£41 million through the high street bank) that RBS returned to customers due to lost interest and unfair charges or paid out in compensation.

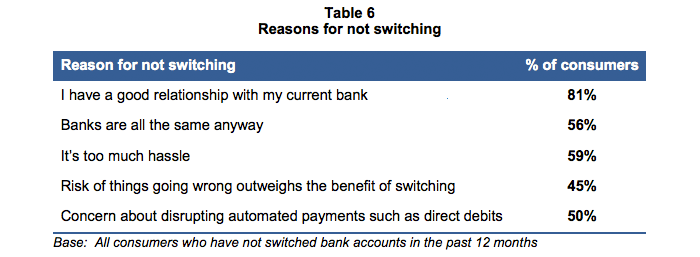

However, customers still could have left after compensation was awarded so it seems more likely that they stayed for the most familiar reasons in this market.

Source: Payments Council September 2012 report available here

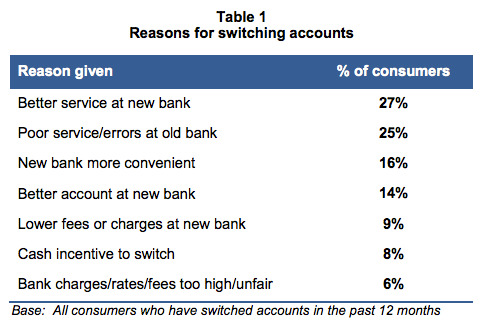

Concerns that switching current accounts is too risky or too much hassle do seem to have been partly allayed by the seven day switch service.

As we've reported before there was an increase in switching in the months after the service was introduced.

This month, the Payments Council reported a 17% rise in the number of customers moving accounts in the fourth quarter of 2013 compared with the same period the year before.

The council said the scheme wasn't just a success in terms of perception: in 99.6% of cases the switch was completed in the seven day target period.

Source: Payments Council September 2012 report available here

Waiting for compensation

Whether they're thinking of switching or not, many Lloyds customers are currently waiting for compensation from this week's outages.

When RBS and Natwest gave out compensation they asked customers to provide evidence of any ways the outage had negatively affected them - late payment fines, for example - and repaid them.

They also gave out some compensation for emotional distress.

Martin Lewis of Moneysavingexpert suggested on Sunday night that the RBS outage case set the standard for compensation in similar situations and that Lloyds customers should therefore be entitled to the same level of redress.

However, Lloyds Group banks haven't responded specifically to that claim, saying they'll treat each claim for compensation on a case by case basis.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties