Tracking and, ultimately, improving our finances is an irresistibly simple idea. It's advice that most of us have either given or been given, and probably both, at some point.

Yet like always the problem is: putting theory into practice.

So here we offer some top tips to help aspiring budgeters.

Making budgets work

Let's start with three tips that could help smooth the way, whichever budgeting method you use.

1. Do less

As research for this article we looked at hundreds of budgets online, and in personal finance books, and most of them had one big problem: they were far too complicated.

Many advocate an estimated spend and then suggest tracking actual spending day-to-day across pages and pages of categories. This is too much for anybody.

Of course, it's always useful to get a snapshot of where your money's going. Yes, we're invoking the latte defence - where a person may be spending far more than they realise on small transactions.

However, trying to keep up with a labour intensive list of everything you buy is, by and large, a useless waste of time. Like making endless to-do lists rather than actually doing the stuff on the list (or is that just us?).

The take away: create a way of budgeting that 'works' without having to pay it constant, will-sapping attention.

For example, ditching direct debits and standing orders for barely used services and setting up new payments for more important stuff like savings goals or credit card payments, could take an hour and needs little or no maintenance: more here.

2. Set manageable goals

Similarly, we noticed that many budgeting techniques drive people to reduce the cost of everything all at once.

Again, a noble aim but totally unrealistic.

In his book Change or Die, Alan Deutschman notes that, in one hospital, 90% of people who were asked to change their diet after major heart surgery - to literally change or die - couldn't manage it.

Big vague goals like lifestyle change, Deutschman says, are really hard to make.

The take away: set smaller, more manageable goals.

Smaller goals are less daunting, more realistic and consequently easier to stick to. For instance, quitting chocolate cold turkey is a bold endeavour for most of us but chances are we'll be binging back on the good stuff within a week. Limiting ourselves to just a bar a week, or twice a week, however, is much more achievable and likely to prevent us falling at the first chocolate coated hurdle.

3. Fail better

Beckett wrote, "Ever failed. No matter. Try again. Fail again. Fail better."

While we can't all aspire to Beckett's Noble Prize, fail better standard, the point is still well taken.

Everyone will probably fail in their budgeting efforts at some point, the trick is finding a way to keep trying and, hopefully, fail less next time.

Many people find it easier to predict their spending for the coming year much more accurately than they can estimate outgoings for the next month.

The difference, when budgeting longterm people tend to factor in a 'buffer amount' to cover any unexpected expenses.

It seems that everyone expects setbacks and unexpected expediture to crop up from time to time, but envision them occuring later rather than sooner.

The take away: Be prepared to fail. In fact, budget for it.

Budgets we love

As we've seen above, everyone should find a budgeting method that works for their income and is in line with their own expenditure goals.

But we can all do with some examples of how this might actually works.

The month budget

- Use it to: get to the end of month.

- View and download it from Google docs.

- Download it as an Excel file.

According to R3, about half of Britons struggle to make their salary last until their next payday.

25% of respondents to an NS&I poll said they felt guilty after overspending because they hadn't planned ahead. Three quarters said they worried about money.

Figures like these reflect the fact that, generally, costs are rising. In fact, in some places, like the rental market, they're rising quite a lot - while wages, again generally, have stagnated.

On an individual level, in other words, many people have got less cash to play with once they've paid for the essentials.

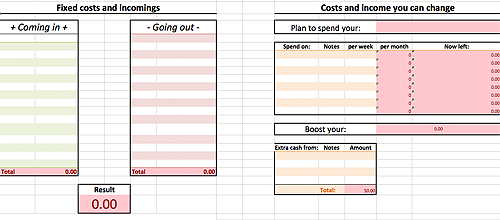

For this reason we thought a budget that separated 'fixed' costs from costs that varied each month would be useful.

The Excel sheet includes some quick calculations to add up the columns so don't type in those boxes (marked in red on the picture) for best results.

There are several different sheets to the Excel file: a blank budget, an example and a sheet of notes and suggestions.

The debt eliminating budget

- Use it to: pay off multiple unsecured debts.

- View and download it from Google docs.

- Download it as an Excel file.

Another budget we really like is this one for crunching through multiple debts.

It's really simple and really focused on goals and motivation in a way that some research claims really works.

Some people call it the snowball method and the very simple idea behind it is that paying off your smallest debt in full - no matter the interest rate - and then moving on to the next one will be much more effective than trying to pay down several at once or going for the highest interest rate first (which makes the most logical sense).

There are some caveats, of course.

The method is best used for unsecured debts like credit cards, overdrafts and personal loans (when they can be overpaid).

No matter their size, priority debts like energy, rent arrears or council tax must always come first.

Find more information and an example sheet in the Excel/Google Docs files.

If someone is having trouble meeting debt repayments, especially priority debts, or feeling overwhelmed they may benefit from more in depth help from an expert. Have a look at our guide to what's on offer.

Using account aggregators to budget

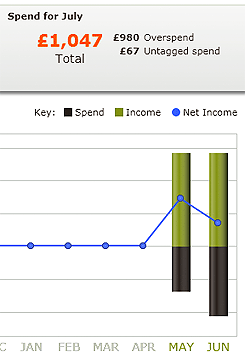

Another budgeting option we like the sound of are account aggregators which promise to bring together all internet banking accounts, categorise purchases and let individuals know when they've gone over budget, perhaps in the form of a colourful graph.

In other words, they promise to take away the annoying legwork involved in making a budget.

We take a look at two of the most popular aggregators out there.

Lovemoney

Of the two, Lovemoney has the most intuitive and usable layout.

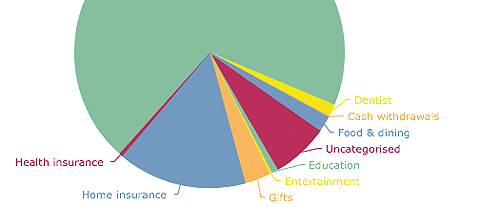

When banking details are entered the application downloads purchases and payment information from the past three months and puts all that data into clear, colourful charts like the one below so that users can see just where their money is going.

That's the theory anyway.

In practice, we found that Lovemoney struggled to automatically categorise purchases by type and, worse, rarely seemed to learn the right category for the same store for future reference.

With some attention to detail we're sure this problem could be overcome but it's a bit of a pain especially considering that the budget function depends on these categories.

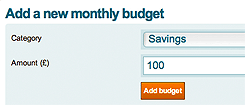

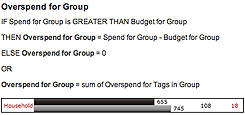

A monthly budget goal can be set as shown in the screenshot to the right.

Note that users can change the month start date to fit with their payday, which is a nice touch.

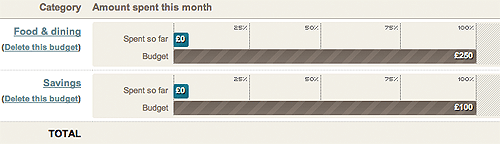

Once your budget goals are set Lovemoney will track your progress on bar graphs.

Money Dashboard

Money Dashboard is very similar but perhaps not as pretty to look at and can also be a little confusing.

Like Lovemoney, users can see all their accounts (or at least all those with online banking). Yet to see specific spending categories individuals will have to work this out themselves.

The graphs are a nice plus, though.

It's nice to be able to view a number of accounts in one place, it's exactly the unbiased overview needed from a budget.

However, for those hoping for a budgeting technique that takes the work out of keeping track of your finances we're sorry, this isn't it.

Ever avoided facing the mess that awaits when you logging into online banking? Us too. And we did the same thing with these services.

As useful as they are, finding motivation remains as important as ever.

Security problems

More seriously, these sites have a security problem: you're essentially letting a third party have access to your online banking details.

What's worse, in the event of fraud banks have warned that customers won't be covered for the loss since it constitutes acting without reasonable care.

Mobile budgeting

For those living life in the fast lane, spending a few hours a month chained to a computer budget-managing may seem like a big ask but before this gets used as an excuse, we'd like to introduce the latest line of tech savvy budgeting tools - mobile apps.

You Need a Budget (YNAB) is getting a lot of good press at the moment and, with their bold claim that the average user saves over £2,000 in the first nine months, it's easy to see why.

Using the familiar and easy to navigate spreadsheet format YNAB divides income across several money pots and produces charts and graphs to help users visualise where their money is being spent, much in the same way as aggregators like Lovemoney.

However, YNAB is different from other tools in that it calculates budgets based on previous earnings rather than predicted future income in a bid to stop users living from payday to payday.

It also has one big advantage over competitors, it doesn't connect to bank accounts directly, giving users peace of mind about their financial security.

The drawback to this though means time must be spent uploading financial details manually, albeit according to our experience this takes a mere 5-10 minutes each month. Other disadvantages include the monthly £3.50 fee as well as the need to use the mobile app in conjunction with a desktop version.

Goodbudget is another popular app, which again splits expenditure across categories, this time "envelopes", to help with budgeting.

Yet unlike YNAB it's free to use and has a system that not only syncs across different devices but other users too. Meaning household budgets can be easily managed between couples.

For those looking for a more in depth monitoring of their spending habits, Wally is an app that offers a "360-degree view" of finances, which alongside tracking usual expenditure details also uses smartphone location information to monitor exactly where users are spending their cash.

Plus it's free to use and doesn't rely on or sync with a desktop program, making it one of the only bona fide budgeting mobile apps out there.

Use mobile apps to save money too

Rather than operating solely as budget management tools, mobile apps can also be used to help save money and ultimately improve people's overall financial situations.

From price comparison apps like Mysupermarket and Idealo, that help shoppers find the cheapest available products, to cashback apps such as Snap & Save and Quidco, that give you money and rewards for your purchases, it seems our phones are bursting with great opportunities to help us save.

All in all, by setting small, realistic goals and using various tools, from old school spreadsheets to thrifty new mobile apps, both setting a budget and sticking to it has never been more manageable.

Comments