Home > Broadband > News > Broadband competition spreads, but 10% still left out

Broadband competition spreads, but 10% still left out

10% of households are still stuck with uncompetitive broadband exchanges, Ofcom's latest market review has found.

Lack of competition in an exchange area often means poor speeds and higher prices for consumers.

Ofcom found that while the area of the UK with effective competition has grown from 77.6% in 2010 to 89.7% in 2013, 10% are still left out and that's unlikely to change anytime soon.

As a result of its review, Ofcom is proposing a reclassification of the UK's geographical broadband markets, with continued pricing controls on BT's wholesale services in the least competitive remaining 10%.

Area change

The continued rollout of LLU was determined to be the reason behind the expansion of competition, where providers such as TalkTalk, Sky and O2 have been installing their own equipment in exchanges.

However, it's already been noted that this rollout has slowed pace, and more that it's unlikely to continue much further as the cost of unbundling exceeds any chance of profitability in the remaining exchanges.

BDUK funding means that BT must rollout its fibre network to rural areas, however the majority of BT's rollout has been largely focused in already competitive parts of the UK.

In other words, for the last 10% of the UK any future chance of increased competition is slim and at best uncertain.

New market categories

In May 2008 Ofcom introduced categories to telephone exchanges based on the level of competition in any one exchange.

These market categories led some ISPs to offer geographical pricing - that is, cheaper prices in areas where wholesale prices were less and competition was greater.

Ofcom are now proposing a change to these categories, reducing the number from four to three due to increased competition throughout more areas of the UK.

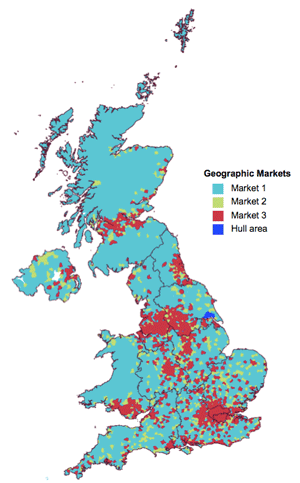

The current markets are:

- Market 1: 11.7% of UK premises - where only BT is present

- Market 2: 10% of UK premises - there are two-to-three providers present

- Market 3: 77.6% of UK premises - there are three-to-four or more providers present

The new proposed markets would be:

- Market A: 9.6% of UK premises - there are no more than two providers present

- Market B: 89.7% of UK premises - there are three or more providers present

In particular it's worth noting that many premises currently in Market 2 would be re-categorised to Market B and therefore become unregulated, so consumers living in these areas would benefit from cheaper prices from any providers using geographical pricing, currently that's Plusnet and EE.

Problems for the 10%

For the remaining 10% of the UK in the new Market A category, the main concern in Ofcom's report is that this area is increasingly unlikely to see any more providers enter these exchanges.

LLU is seen as too unprofitable in many areas, and doubly so for multiple providers where exchanges serve such few premises.

While BDUK funding could see the remaining 10% in Market A areas receive fibre connections, there are uncertainties around the time frame of the rollout as well as the specific areas to be connected.

"It is too early to rely on the deployment of [fibre] in considering [competition] in Market A" noted Ofcom.

BT has already been quoted as saying that only once they've completed their commercial rollout of fibre will they be able to fully focus on the rollout of fibre funded by public money into the 'final third' of the UK.

Pricing controls

While more of the UK will become unregulated under these new proposals, the remaining 10% will continue to be regulated.

Regulation will include continued pricing controls on BT's wholesale services to ensure it's cost effective for competing providers to operate in these areas and that consumers don't become subject to excessive pricing.

In similar proposals also released this month, Ofcom is proposing unrelated price controls on BT's wholesale broadband services throughout the UK in a bid to reduce the cost of broadband and phone for consumers.

Price controls will be in the form of year on year reductions of inflation minus a set percentage.

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

14 March 2024

One Touch Switch system for broadband delayed again

19 February 2024

Virgin Media to offer its broadband network wholesaleGet insider tips and the latest offers in our newsletter